Your Canadian Wealth Management Guides

The mainstream Canadian investment advice focuses on returns when it should really be focused on growing and protecting your “investment pile” through asset accumulation and income tax minimization.

This is especially true for Canadian incorporated business owners and Canadian investors whose active and passive income is taxed at 39% to 54% depending on how you earn income at the personal level.

“All Canadians have the opportunity to build generational wealth when armed with the proper understanding, tools and support.”

The Financial “Rulebook” Says:

… go to school and get good grades so you can find a good paying job with benefits and a defined benefit or company match pension plan.

… save as much as you can to form a down payment to buy a home and begin paying off the mortgage as fast as you can.

… maximize your RRSP, TFSA, FHSA and RESP contributions and invest those dollars in a mutual fund your big bank advisor recommends to “diversify” your Canadian portfolio.

… purchasing real estate is too hard, too expensive and much too risky for the typical Canadian investor or incorporated business owner.

… investing in the stock market is too complex to do without an expensive financial advisor and too hard to learn on your own without simply gambling.

… you should always buy term life insurance and invest the rest and never purchase participating whole life insurance.

… only certain types of people can be entrepreneurs. Starting a business or “side hustle” requires luck and is always a gamble.

How’s that working out for you?

How’s that working out for them?

There is another way. Let us help you get there.

We Are Canadian Wealth Secrets…

…a team committed to sharing the Canadian Wealth Secrets that should be common knowledge for all.

Have you ever felt like for decades you were doing what you thought were the right things?

You know: living under your means, saving that down payment for a home, paying extra on your mortgage each month, taking advantage of company match retirement opportunities or putting away as much of your incorporated business retained earnings, maybe even putting some money into mutual funds or private managed funds.

Then, a year or ten down the road, it dawns on you…

Your mortgage balance has decreased some, your retirement plan has some money in it (but not enough to retire on) and you aren’t buried under a bunch of credit card debt, but there is still one problem:

Your lifestyle is exactly the same and you certainly don’t feel any wealthier than you did when you first started.

If this story sounds familiar to you, then you’ll definitely fit in here.

That was exactly how we felt when we were trying to do “all the right things” that traditional Canadian financial planning would teach us.

Before we go on, let’s be clear on one thing:

Following the traditional financial planning advice is certainly a great start and better than living above your means to ensure you build some equity in your primary residence and hit retirement age without a steep mountain of debt.

The problem is that you’ve had to make significant financial sacrafices for what seems like not such a great payoff in the end.

It begs one to question whether this traditional approach to teaching financial responsibility is a path to building wealth and financial freedom or whether it is just a path to just getting by?

What if there was a better way?

Canadian Wealth Secrets was founded by two (2) former high school mathematics teachers and mathematics consultants who steadily built their wealth through the success of their Canadian incorporated consulting business and real estate holding companies.

Although both Kyle Pearce and Jon Orr were passional educators, they are also eager serial entrepreneurs who are fuelled to grow and scale their businesses while creating financial freedom throughout the process.

Along the way, they have learned that building wealth and financial freedom in Canada involves consistently growing their investment “pile” and protecting that pile through tax minimization strategies.

Supporting Canadian Business Owners and Investors

While most of our Canadian wealth building learning has been to support our own financial freedom goals, we now work tirelessly to assist Canadian business owners, entrepreneurs and investors to learn and execute a variety of investment strategies, wealth building structures and tax minimization plans to grow and protect their own assets to grow their net worth over time.

We like to think of the Canadian Wealth Secrets community of learners as Canadian Wealth Secret Seekers.

If you are a successful incorporated Canadian business owner or a high income T4 earner, you should reach out for a free discovery call so we can assist you with growing and protecting your pile on your journey to financial freedom.

Meet The Canadian Wealth Secrets Team

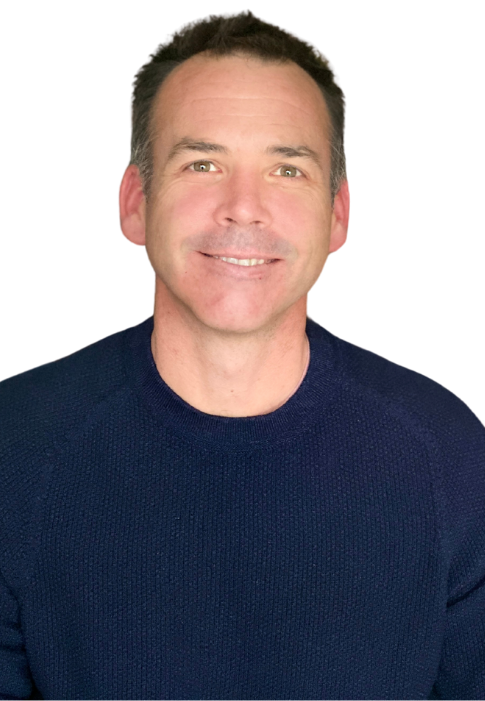

Kyle Pearce

Kyle is a former secondary mathematics teacher and consultant who built multiple businesses and real estate holding companies simultaneously. After running into many of the common Canadian income tax challenges that active and passive income generating business owners face, he spent a decade solving this problem and now spends his time assisting investors, entrepreneurs, and high net worth clients minimize income taxes to maximize their opportunity to accumulate assets as a corporate wealth management and insurance advisor.

Kyle is an active real estate investor and stock options trader with a passion to educate other Canadian incorporated business owners and investors to keep more of their hard earned capital.

Jon Orr

Jon was a secondary mathematics teacher who is earlier along his financial freedom journey after teamming up with Kyle back in 2018 to launch their Make Math Moments side-hustle business doing the work he loves: helping more students learn more math in effective and engaging ways.

It didn’t take long for Jon to realize that Kyle had investment and wealth building plans for the extra cashflow they were generating through their passion project math business. Being a lifelong learner, Jon listened to all of the recommended audiobooks, podcasts and engaged in long mentorship conversations to shift his mindset from a save and spend mentality to an investor’s mindset.

The first substaintial amount of profit Jon generated from his portion of his side-hustle business went towards a real estate joint venture (JV) partnership with Kyle and his real estate partner Matt Biggley’s North Shore Properties and they continue to partner on deals as opportunities arise.

Design Your Wealth Management Plan

Crafting a robust corporate wealth management plan for your Canadian incorporated business is not just about today—it's about securing your financial future during the years that you are still excited to be working in the business as well as after you are ready to step away. The earlier you invest the time and energy into designing a corporate wealth management plan that begins by focusing on income tax planning to minimize income taxes and maximize the capital available for investment, the more time you have for your net worth to grow and compound over the years to create generational wealth and a legacy that lasts.

Don't wait until tomorrow—lay the foundation for a successful corporate wealth management plan with a focus on tax planning and including a robust estate plan today.

Insure & Protect

Protecting Canadian incorporated business owners, entrepreneurs and investors with support regarding corporate structuring, legal documents, insurance and related protections.

INCOME TAX PLANNING

Unique, efficient and compliant Canadian income tax planning strategy that incorporated business owners and investors would be using if they could, but have never had access to.

ESTATE PLANNING

Grow your net worth into a legacy that lasts generations with a Canadian corporate tax planning strategy that leverages tax-efficient structures now with a robust estate plan for later.