Why Inflation Is A Real Estate Investor’s Best Friend

Using Debt to Combat Inflation and Build Wealth

Inflation, that sneaky little devil has always been in our lives, but until recently has gone unnoticed. For the past few decades, inflation has been tamed almost perfectly to eat away at the savings of the low- and middle-class without anyone realizing. Now, as we dust ourselves off from the pandemic period of government stimulus and money printing, the talk of inflation and its impact on the cost of everyday goods and services is the topic of many conversations.

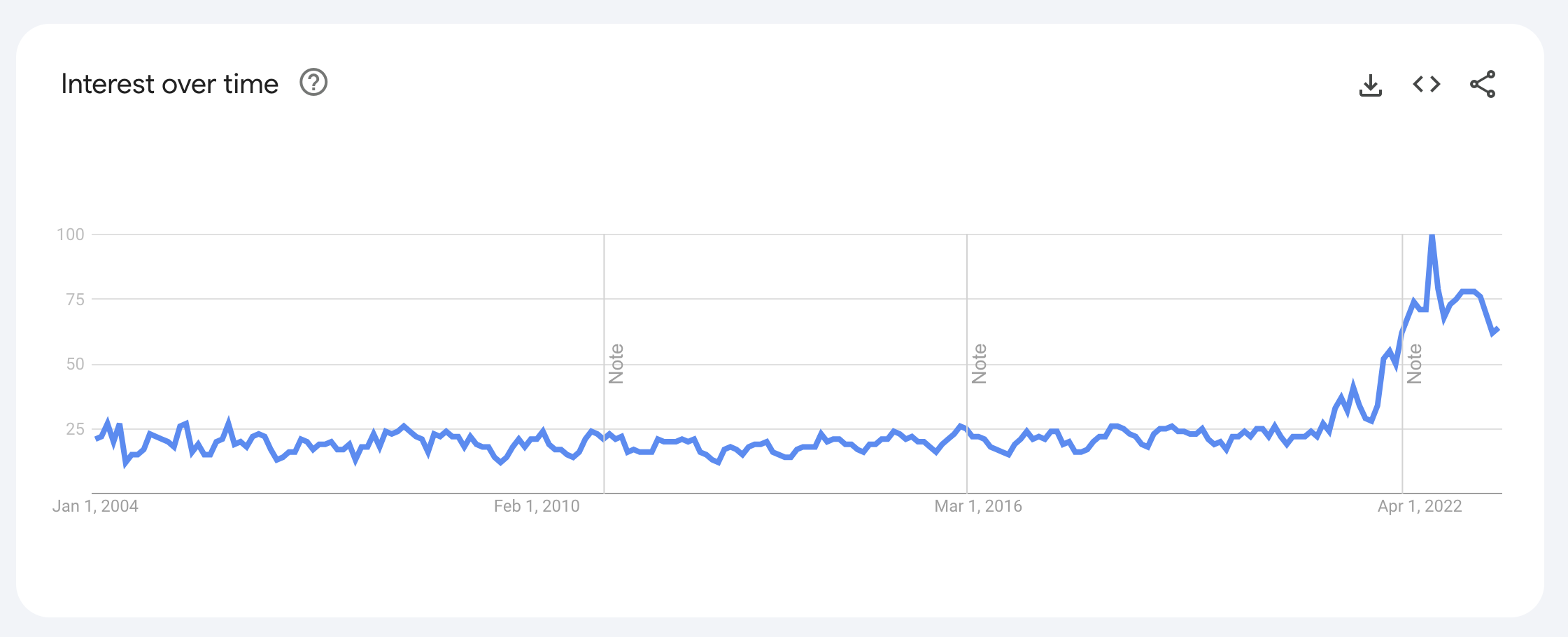

Don’t believe me? Have a look at the number of Google searches involving the word “inflation”:

Google Trend Data for “Inflation”

While I’m betting that all conversations about inflation highlight how bad this sneaky snatcher of wealth really is on the monthly budget, there are some not so well-known characteristics of inflation that actually act as a secret weapon to the battle against debt.

Yes, there is a silver lining for some when inflation begins to spiral out of control.

Picture this: you took out a loan a while back and now you’re drowning in debt. It feels like a never-ending nightmare, right? Well, here’s where inflation swoops in to save the day, like a hero in disguise.

As inflation goes into overdrive, the value of your debt starts to shrink, just like a balloon losing air. It’s like having a magical financial sidekick that lightens your debt burden without you even noticing.

Here’s the deal: the amount you borrowed stays the same on paper, but as prices skyrocket, the real value of your debt decreases. It’s like watching your debt fade away while you carry on with your daily grind.

It’s like debt magic!

Now, while we certainly aren’t advocating that you go out and get yourself buried in what Robert Kiyosaki calls “bad debt”, but what we are saying is that inflation actually helps you grow your wealth faster as asset prices increase and the value of any “good debt” tied to those assets lose value.

Let’s break it down with an example…

Imagine you obtained a $400,000 mortgage on a rental property a few years ago. Now, if inflation has been trotting along at a steady 3% every year, that $400,000 is worth less in today’s money than it was when the mortgage was originated. Inflation is slowly deflating your debt, making it less scary to pay off over time. It’s like the financial universe is rewarding you for buying an asset on leverage and creating a 4th silver bullet of real estate investing.

But hold your horses, ’cause inflation’s got more tricks up its sleeve. It can also give your rental property income a sneaky boost.

When the rate of inflation is high and the price of goods and services go up, so does the rents on your income property. So, while expenses such as utilities, insurance and property taxes are increasing in price, your rental income should also be increasing at a similar pace. If you had purchased the property where the rental income was higher than expenses and the monthly mortgage payment, then the result should be a net win for your income vs. expenses. So, in summary, inflation can silently beef up your earning power and ultimately give you a rental property pay raise without anyone realizing it. Sneaky, right?

Now, before you start celebrating, let’s throw in a word of caution…

Not all debts are created equal and of course, there are some caveats to these benefits.

If you’re stuck with a mortgage that has a variable interest rate or a fixed rate with a term coming due shortly while interest rates are high, inflation might not feel like your financial superhero. If you get caught in a situation where the interest rate on your investment property mortgage is climbing right alongside inflation, then you’re more than likely going to be just hoping to “break even” when it comes to your real net worth pre- vs. post-inflation. It’s a delicate balancing act, but being aware of how inflation works for you and against you is key.

Of course, we also need to look at the worst case scenarios associated with inflation. When inflation gets out of control, it can turn into hyperinflation and it can wreak havoc on your finances fast. Suddenly, your good and bad debt becomes a colossal monster that’s tough to tame. It’s like going from a superhero movie to a disaster flick real quick.

So, while inflation can be a secret weapon against the good debt you are carrying, remember that keeping it in check is a better scenario for all involved.

Play the inflation game wisely, my friend. Use it to your advantage, but always keep an eye on your financial battlefield.

Are you interested in getting yourself started in real estate investing? Learn about joint venture opportunities and take the first step towards financial freedom.

We believe that anyone can build generational wealth with the proper understanding, tools and support.

Design Your Wealth Management Plan

Crafting a robust corporate wealth management plan for your Canadian incorporated business is not just about today—it's about securing your financial future during the years that you are still excited to be working in the business as well as after you are ready to step away. The earlier you invest the time and energy into designing a corporate wealth management plan that begins by focusing on income tax planning to minimize income taxes and maximize the capital available for investment, the more time you have for your net worth to grow and compound over the years to create generational wealth and a legacy that lasts.

Don't wait until tomorrow—lay the foundation for a successful corporate wealth management plan with a focus on tax planning and including a robust estate plan today.

Insure & Protect

Protecting Canadian incorporated business owners, entrepreneurs and investors with support regarding corporate structuring, legal documents, insurance and related protections.

INCOME TAX PLANNING

Unique, efficient and compliant Canadian income tax planning strategy that incorporated business owners and investors would be using if they could, but have never had access to.

ESTATE PLANNING

Grow your net worth into a legacy that lasts generations with a Canadian corporate tax planning strategy that leverages tax-efficient structures now with a robust estate plan for later.

OPTIMIZE YOUR FINANCIAL FUTURE